The Impact of IT Transformation in Private Markets

Digitalization and technological advancements are becoming increasingly important in asset management, including private markets. Asset managers must undergo technological transformation to scale, manage complexity, and innovate. These advancements enhance operational efficiency, security, regulatory compliance, and customer experience. Now, clients have access to more detailed and engaging information about their investments. Additionally, artificial intelligence (AI) boosts productivity and improves decision-making by automating data collection and analysis.

In the dynamic realm of the asset management industry, digitalization and technological innovation play an increasingly crucial role. This is also very relevant for the private markets industry. To succeed, asset managers need to embrace this paradigm shift and embark on a comprehensive IT transformation. Such transformation will allow firms to scale effectively, manage growing complexity, remain at the forefront of digitalization and innovation within the industry and eventually make better investment decisions. Only with such a structured IT plan, private assets managers will be able to improve in efficiency, security, compliance, and the client experience for all the investment strategies and products they offer.

For instance, implementing digital client onboarding and new web functionalities, significantly improves processes and client satisfaction.

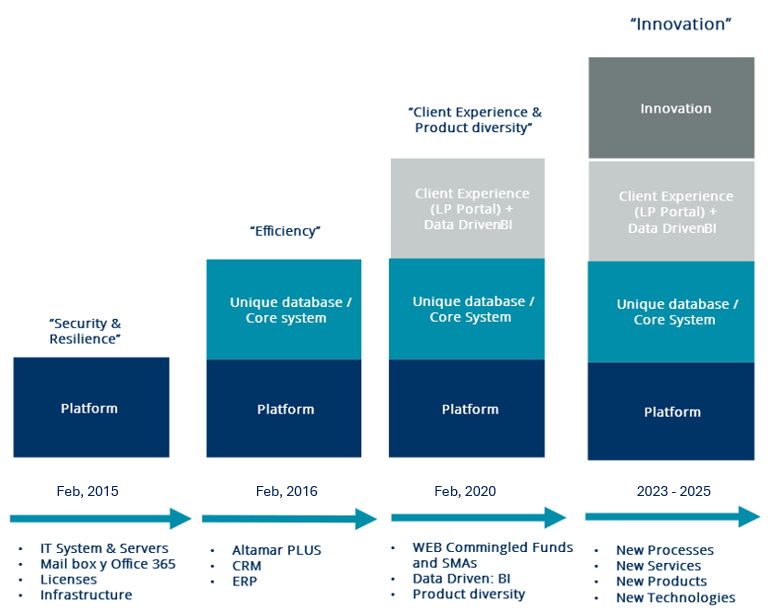

A Strategic IT Transformation Journey

The asset management industry has traditionally outsourced various functions to optimize costs and streamline organizational structures. Today, however, having a platform that enables a unified, high-quality database for comprehensive analysis has become essential for investment teams, investor relations teams, and their LPs. This approach not only improves efficiency but also enhances the quality of vital processes.

In this context, AltamarCAM has developed an in-house solution, Altamar+, after evaluating different applications from external providers. This customized platform is designed to streamline central administration services, transfer agent processes, and portfolio monitoring/reporting, offering an integrated approach compared to other asset managers who outsource these functions to separate providers. It also better controls cybersecurity breaches and reduces operational risks by automating many processes and reducing reliance on Excel.

AltamarCAM’s IT Transformation Plan

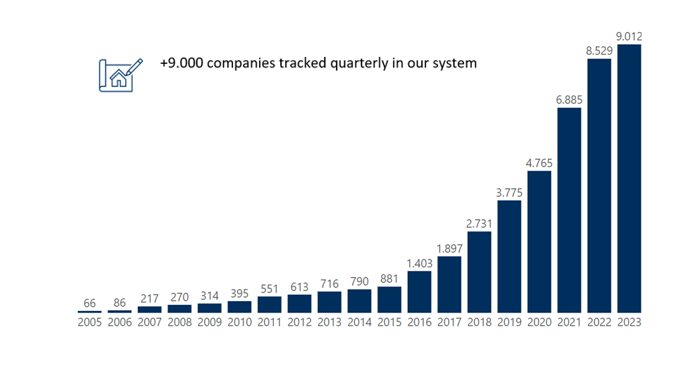

This approach allows to control internally all these functions that are so important to AltamarCAM Fund´s investors. As a result of this plan, from 2016 to 2023, we have been able to manage a 6x increase in quarterly tracked companies.

Evolution of companies tracked in Altamar+

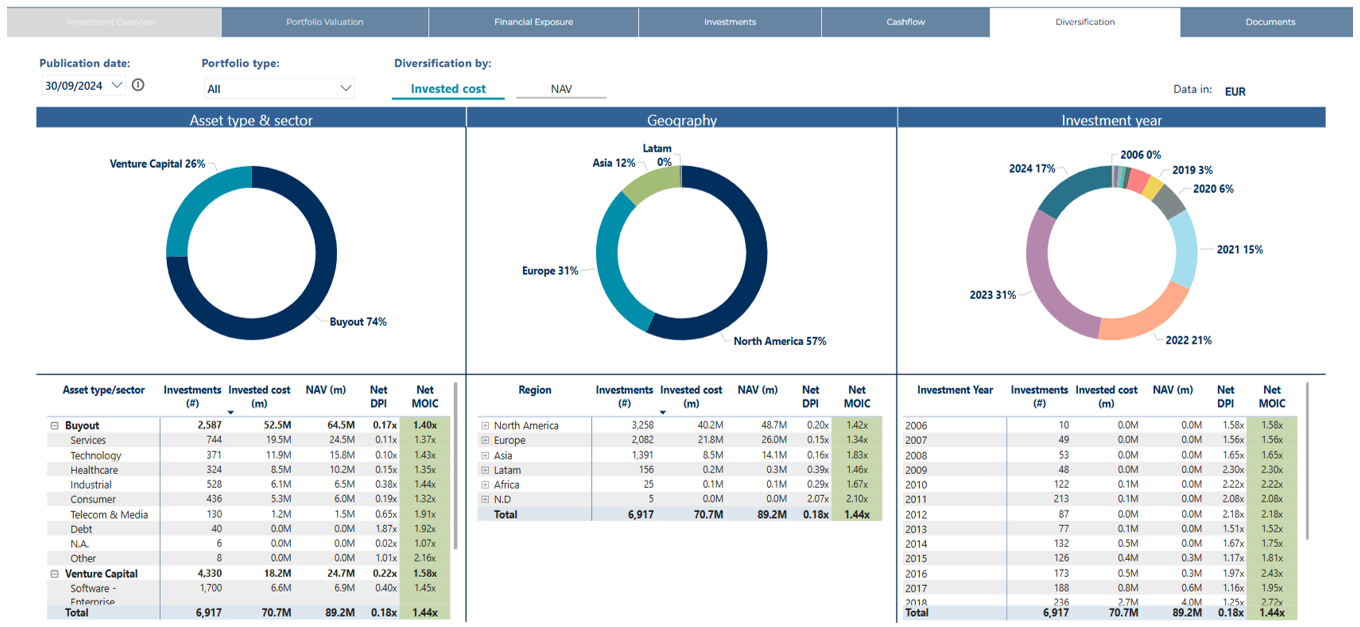

Technological developments are positively transforming asset management, not only by enhancing portfolio monitoring and scaling up certain services, but also by delivering benefits directly to clients. Clients now can have significantly more detailed and accessible information about their investments in private markets.

Whereas years ago, generally, investors had only limited information about their investment portfolios, now with the existing technology they are able to have much more information about their private market’s portfolio, and in a much more visual format. This is especially relevant for

some institutional investors such as insurance companies that require extensive portfolio information for regulatory reasons, as well as pension funds or Separately Managed Accounts (SMAs) for the risk management of their portfolios. In the case of Private Wealth Management (PWM) investors, this technology allows to deep dive in the investment portfolios and positively contribute to different reporting initiatives.

For instance, we believe it is of vital importance having a unified database to enable the development of a Business Intelligence (BI) and Market Intelligence, enhancing internal analysis and client reporting. An LP Portal offers clients comprehensive online information about their positions, beyond just documents. Continuous updates, such as adding dashboards for SMAs, ensure the portal remains a cutting-edge tool for client engagement, delivers a smooth and efficient user experience, improving client´s capacity to handle and analyse investment data.

AltamarCAM’s Website for Separately Managed Accounts

Future: Leveraging Artificial Intelligence

The rise of artificial intelligence (AI) is having a significant impact on the technology sector, especially in the development of programming code, increasing productivity in this field.

In the asset management industry, AI technologies are anticipated to play an essential role. These tools allow collecting data from portfolio companies, which enables better and faster tracking of key performance indicators and improving decision making. We use tools to automatically retrieve all data from the information received by our managers. This field is constantly evolving, so it is expected that many of the processes in use today will be very different in the next 5-10 years.

To stay competitive, asset managers must continuously adapt and strive. Technological improvements are crucial; at AltamarCAM for instance we already use our proprietary ChatGPT models in the investment departments to analyze and summarize large amounts of information, and in our investor relations department to complete Due Diligence Questionnaires (DDQs) with excellent performance and quality results.

At AltamarCAM the IT transformation plan is projected to evolve further over 2023-2025, emphasizing the introduction of new processes, services, products, and technologies to strengthen its market position. Continued investments in IT systems, infrastructure, and client experience improvements remain key aspects of this transformation.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.