Secondary Market in Venture Capital: A Significant Opportunity Going Forward

After a decade in which Venture Capital has established itself as an investment asset by volume of assets managed, returns achieved and legendary companies financed, Venture Capital faces its next phase towards maturity, namely the development of a secondary market similar to that achieved in Buyouts, which started this maturation process over a decade ago.

The secondary market in Venture Capital may offer an attractive liquidity alternative to early investors in highly successful companies, enabling them to monetise significant returns without waiting for an IPO. These investors (or employees), when they have had an undiversified exposure to a successful company for a long period already, are often “paper rich” but “cash poor”, so they are more flexible on pricing to exit. The youth of the Venture Capital secondary market, coupled with more limited access to information in this sector, could create a unique opportunity for those managers experienced in the asset, secondary buyers of Venture Capital with better access to information.

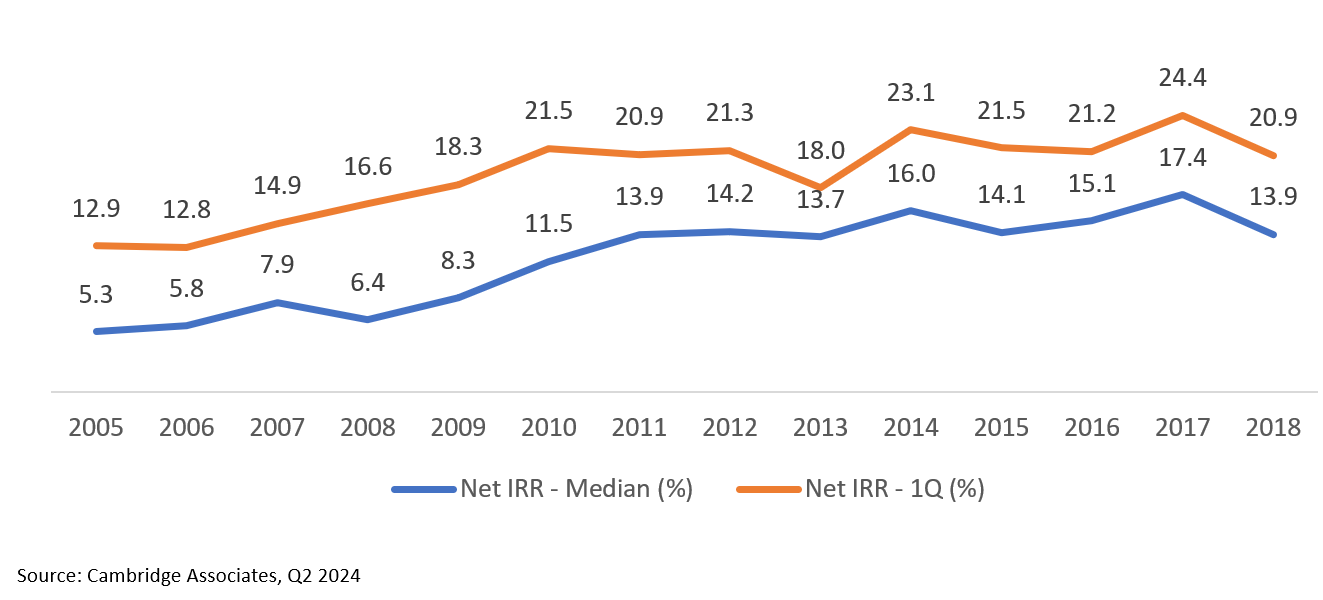

Net IRR of Global Venture Capital & Growth Funds by Vintage

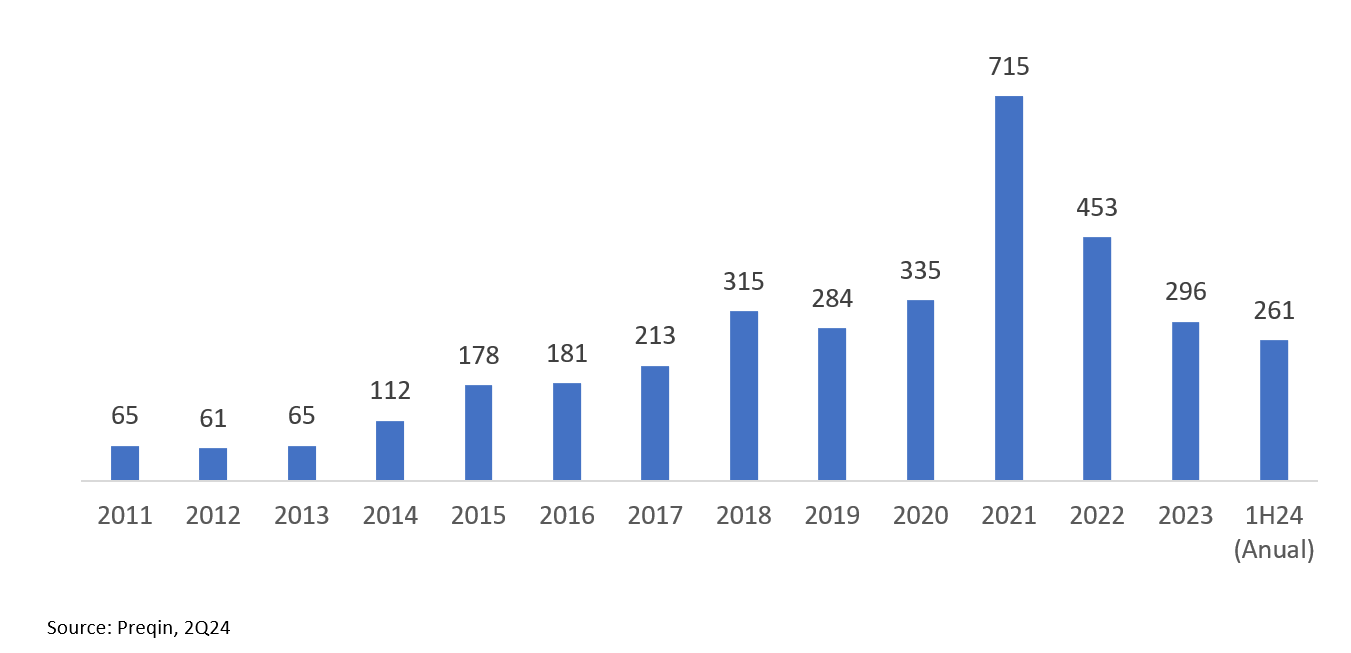

Aside from 2021, when investment in Venture Capital firms reached a record $715bn worldwide, this figure has stabilised around $300bn/year since 2018, well above the average of $60bn/year prior to 2014.

Total Annual Value in Venture Capital Transactions ($bn)

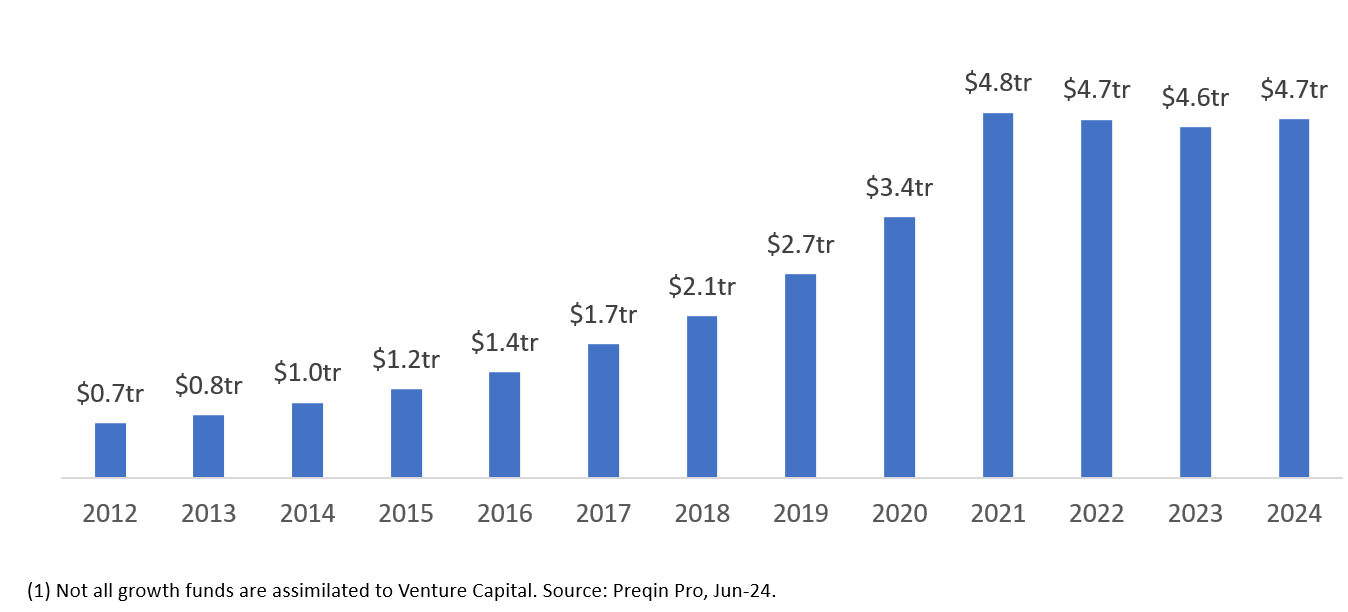

This growth in the sector has led to assets under management of primary Venture Capital and Growth(1) funds reaching $4.7tr, surpassing the assets under management of primary Buyout funds, which total $4.0tr.

Assets Under Management in VC & Growth (1) ($tr)

However, while the primary markets of Buyout ($4.0tr of AUM in 2024) on the one hand, and Venture Capital & Growth ($4.7tr of AUM in 2024) on the other are similar in size, Venture Capital & Growth still has a pending task in developing its own secondary market, something Buyout started decades ago.

The Private Equity secondary market provides GPs with an additional alternative to M&A and IPOs as a liquidity mechanism for investors in private companies and a way to generate liquidity for LPs before the maturation of their funds.

In the case of Venture Capital, where investors often enter early in the life cycle of startups, some of which become highly successful, two factors favour the secondary market. On the one hand, these investors have unrealised returns that are extremely high, but on the other hand, they are also exposed to very long holding periods. All this means that sellers of secondary interests in Venture Capital are willing to offer favourable terms to buyers in exchange for monetising their most successful investments without having to wait for the company’s sale or IPO.

Within this secondary market, there are various types of transactions such as:

- (1) Direct Secondaries (GP-Led), where a fund buys stakes in companies from existing investors or employees. They provide buyers with the combination of lower price sensitivity of the sellers and the ability to invest in specific high-quality companies, after carrying out a detailed due diligence on them. On the other hand, the size of these investment opportunities tends to be small and only mid-size secondary funds can successfully invest if they seek to build a diversified but not overdiversified portfolio.

- (2) Continuation Vehicles (GP-Led), where a VC manager creates a successor fund to extend the life of its investments, particularly in the most successful ones, while giving an exit opportunity to investors who wish to leave and entry opportunity to others who replace them. In these situations, buyers can perform a deep due diligence on the portfolio and deploy large tickets, but with the drawback of limited ability to pick and choose each of the underlying investments.

- (3) Purchase of LP Stakes (LP-Led), where an investor in a fund sells the stake to a third party. In these situations, buyers acquire a mix of good and bad assets, without the ability to diligence them in detail. However, in these cases, the buyer typically can invest at a relatively high discount to NAV.

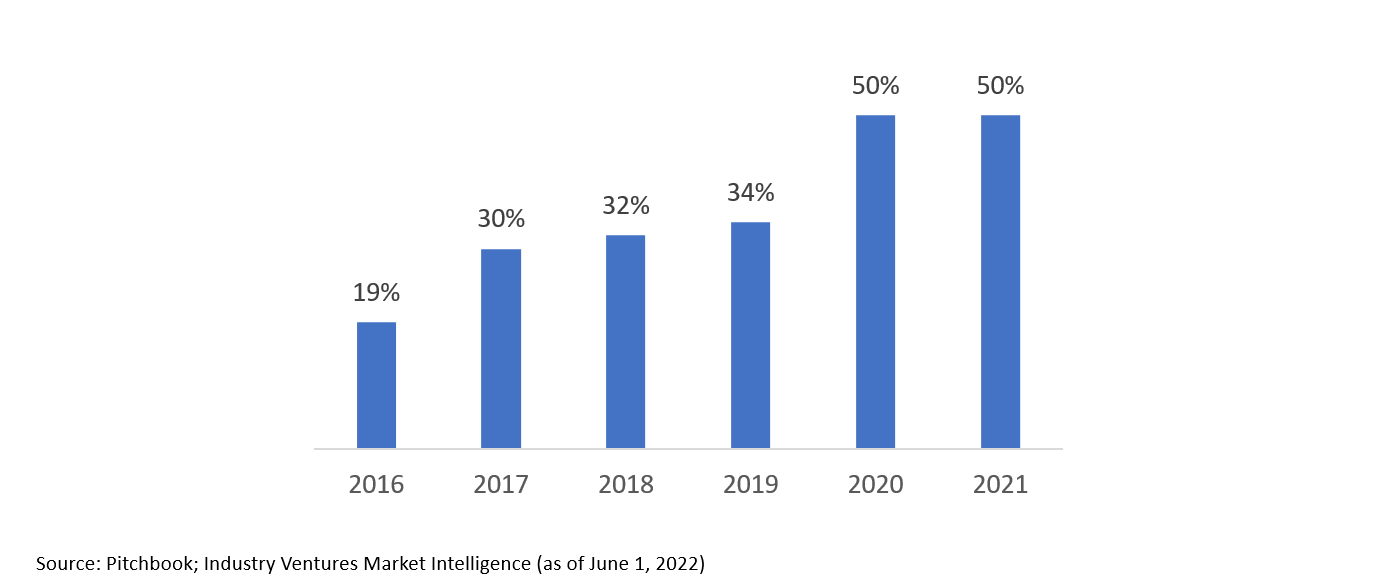

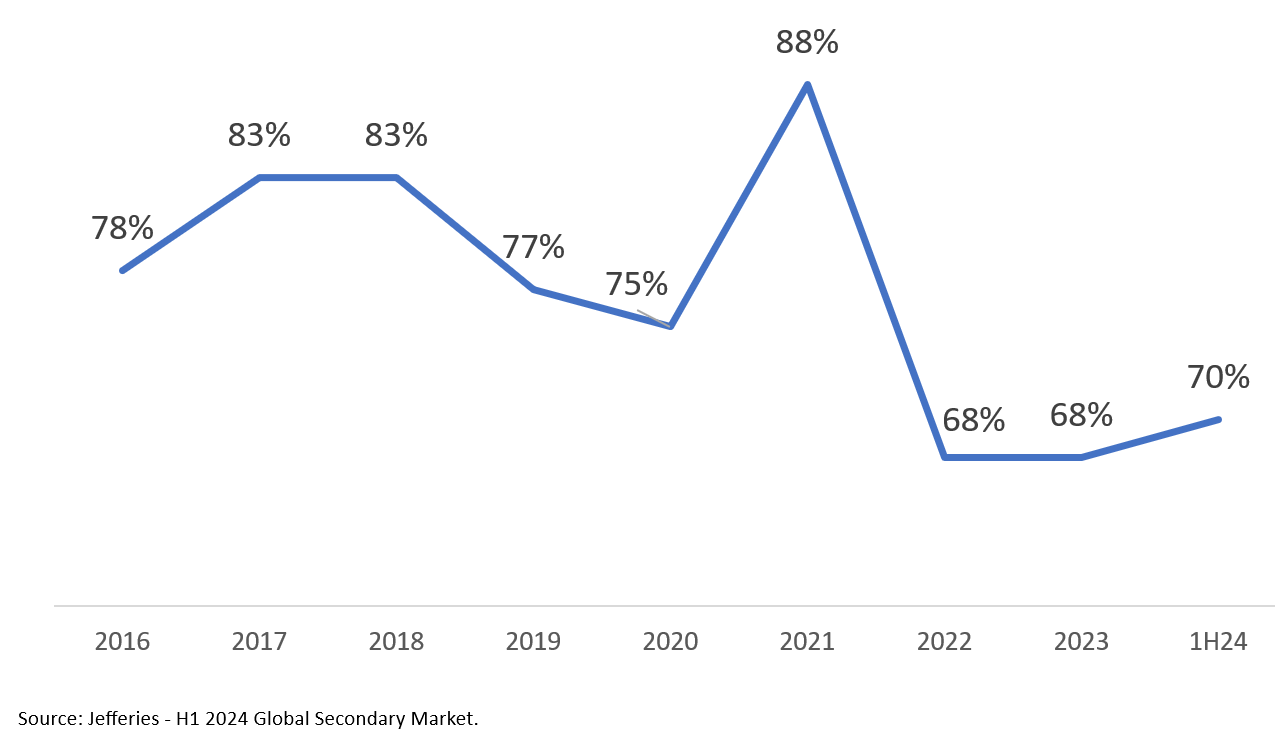

Although historically the LP-led secondaries have represented most of the VC secondary market, the GP-led secondaries are growing faster, and it is the category that we believe will deliver the best risk adjusted returns looking forward.

GP-led Share of Venture Capital Secondary Transactions (vs LP)

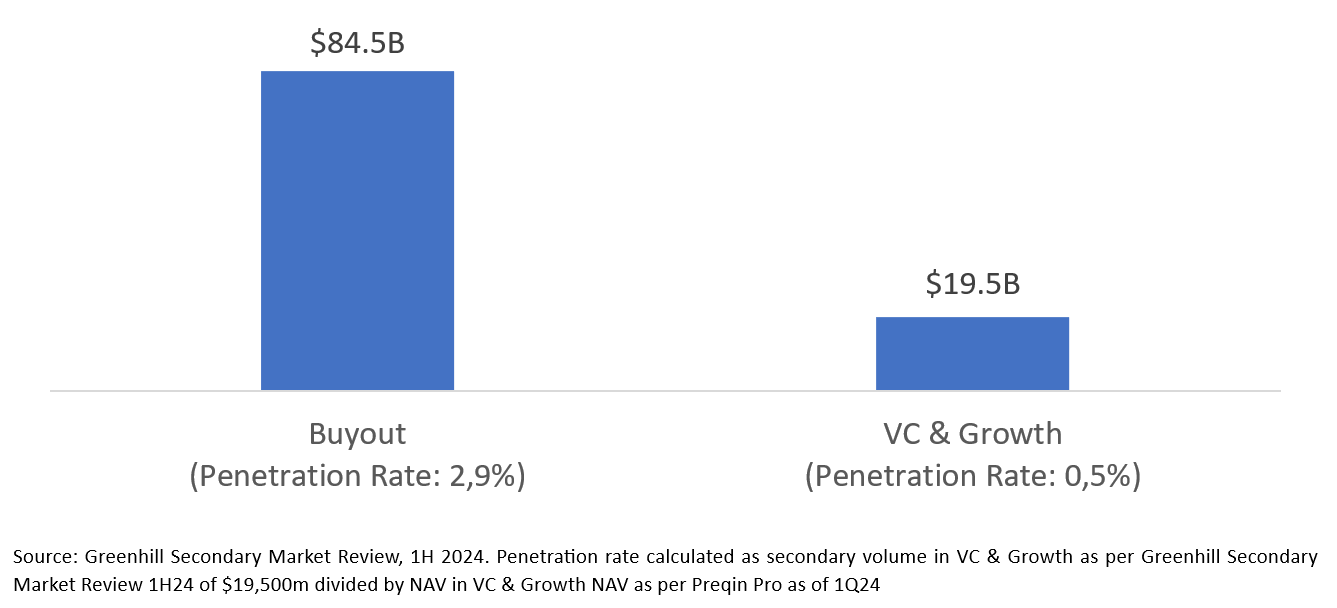

In this regard, the volume of secondary transactions in Venture Capital and Growth is 1/5th of that in Buyout. The penetration rate of secondaries in Venture Capital & Growth is currently only 0.5%, and although we expect significant growth in the sector in the coming years, we believe it will take a long time to reach the 2.9% penetration rate currently seen in Buyout secondaries.

2024 Expected Secondary Deal Activity ($bn) by Asset Class and Penetration Rate (%)

If we take the Buyout market as a reference, it first developed due to its ability to generate good and sustainable returns in primary, and subsequently, a secondary industry emerged that consolidated and enhanced the sector by offering additional liquidity alternatives to investors in that asset. In this sense, what we expect to happen in the Venture Capital sector is that, following the success achieved by the industry through primary funds, in the next 5-10 years, a vibrant secondary market could develop, similar to what happened in Buyout in the last decade.

Analysing the competitive structure of the secondary market in Venture Capital, we can see that the volume of money raised by funds specialised in secondaries of Venture Capital and Growth barely represents 5% of the size of their counterparts in Buyout, which gives an idea of the low maturity of the sector and the potential investment opportunities that may arise from the imbalance between supply (assets under management in primary) and demand for secondaries in Venture Capital (capital of secondary funds).

The secondary market in Venture Capital today, besides being a small and emerging industry, is dominated by a few players who also manage large venture primary capital fund portfolios, with a global investment focus and characterised by having access to the most oversubscribed fund managers who consistently achieve first quartile returns.

To understand why the best managers investing in primary funds are also those who manage the largest Venture Capital secondary funds, we should consider that in the Venture Capital industry, information is limited for those who are not existing investors, thus, being an indirect investor in the best companies and having a close relationship with the managers who have invested directly in them is a competitive advantage for those who have that access and a barrier to entry for those who do not.

Therefore, if we combine the imbalance between supply and demand for Venture Capital secondaries with the limitation on access to information that most potential buyers of secondaries suffer, the result is a potential very favourable investment context for the acquisition of Venture Capital secondaries, for those investors with capital and good information on underlying companies.

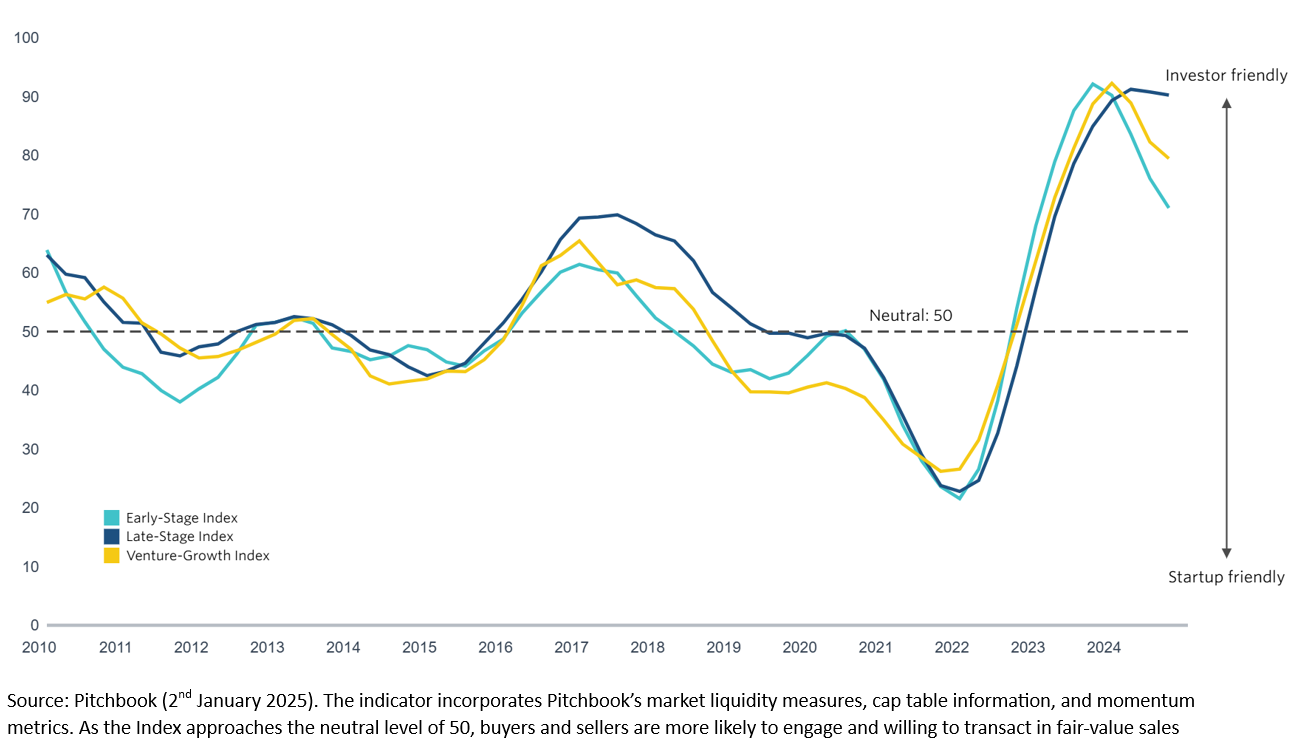

Market Price of LP Interests in VC (% NAV)

After 2 years in which the volume of completed secondary transactions in Venture Capital was very limited due to the high bid-ask spread, in 2024 we have seen the first signs that buyers and sellers are beginning to adjust their expectations and opportunities to buy high-quality Venture Capital assets at very reasonable prices are starting to emerge.

Market Price of LP Interests in VC (% NAV)

It is for all these reasons that we believe the

current secondary market in Venture Capital is optimal for those investors with

good access to information, to invest in unique companies at attractive

valuations, taking advantage of the opportunistic and structural opportunities

offered by this market.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.