Private Equity Cash Flows in Times of Upheaval

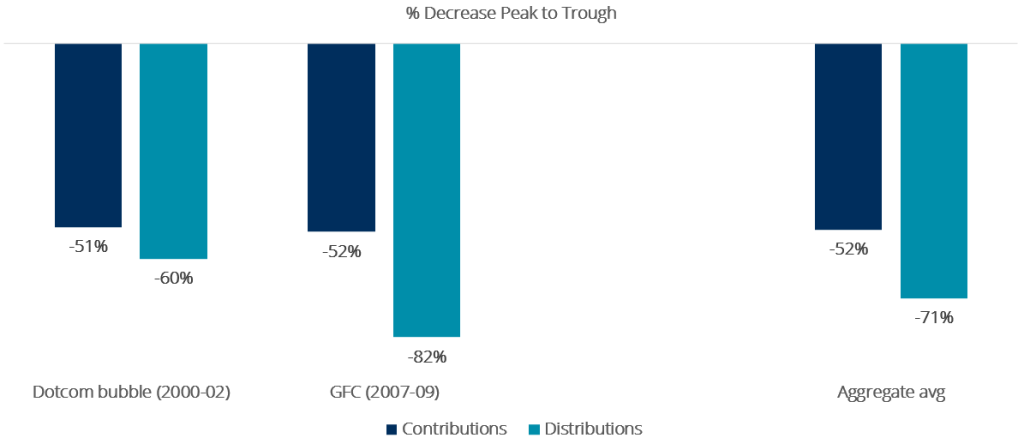

Buyouts experienced sharp falls in activity from peak to trough the year following the beginning of the dotcom bubble crisis, in 2001, and the GFC crisis, in 2009. Capital calls fell an average of about 50% from peak to trough while distributions declined between 60% and 82%.

If economies finally enter recession, private equity activity levels would further contract, in line with what has happened in prior crises, to at least 50% from peak to trough in both investments and distributions. Best returns, however, tend to be achieved in the aftermath of crises and shocks. Market uncertainty, thus, provides key opportunities and compelling reasons to remain invested.

Public markets endured severe corrections during 2022. Economies faced lower demand growth, supply chain disruption, persistent and elevated inflation levels, and interest rate increases. Moreover, we have also experienced major systemic shocks: the global covid pandemic, the Ukraine invasion, and, more recently, an unfolding banking crisis in the US and Europe.

Meanwhile, private markets have performed solidly. We are just starting to see a gradual reduction in investment and exit activity. As recession fears increase, investors naturally wonder how private equity cash flows may be impacted.

We have taken a look at the cash flows of investments in the private markets during the last two severe shocks – the dotcom bubble (2000-2002) and the GFC (2007-2009). There is rich enough data for the private equity buyout segment within Europe and North America. Data on younger segments of the market like infrastructure or real estate is not deep enough.

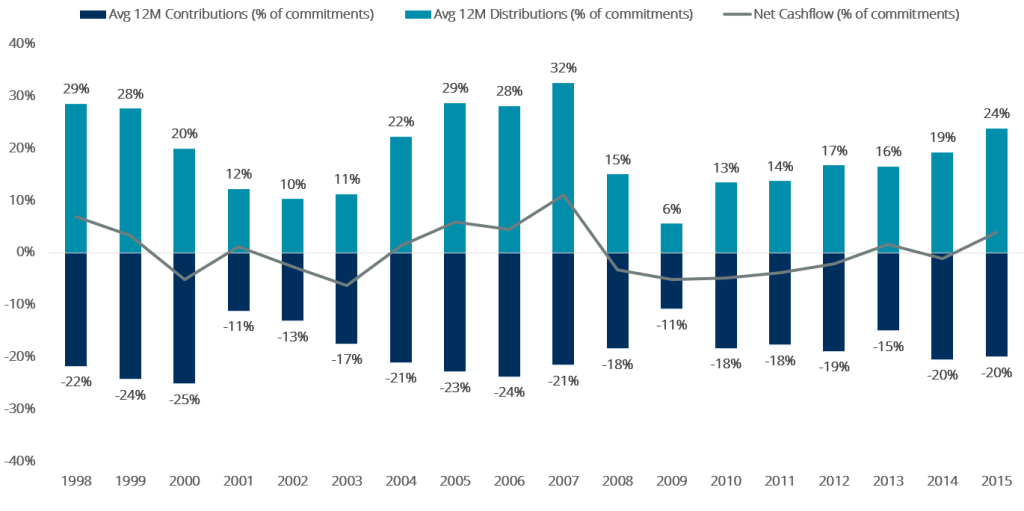

(1998 – 2015; as average % of commitments)

Source: Preqin; Average % of commitments called or contributed (dark blue) and distributed (light blue) by all buyout funds in Europe and North America in each given year, which were either active in investing or selling respectively. In the case of contributions, data refer to all funds which are between 2 and 5 years old in each given year. In the case of distributions, sample includes all funds between 5 and 8 years old. Total sample is formed by 844 funds.

Buyouts experienced sharp falls in activity from peak to trough the year following the beginning of the dotcom bubble crisis, in 2001, and the GFC crisis, in 2009. As we can appreciate, distributions fell more rapidly than capital calls. Private equity managers tend to be prudent in uncertain economic environments and focus on portfolio value creation rather than new platform investments. Managers waited patiently for the right time to exit current portfolio investments. In this context, capital calls fell an average of about 50% from peak to trough, while distributions declined between 60% and 82%:

Peak to trough decline in capital calls and distributions for European and North American buyout funds during the dotcom bubble and the GFC

Source: Preqin; The graph shows the peak to trough decrease in percentage terms between capital calls and distributions, in both cases as a % of committed capital for funds in investing and exit period respectively as stated in first graph footnote. The sample considers European and North American buyout funds only. The dotcom bubble section compares average contributions as % of commitments in 1999-2000 (peak) with 2001-02 (through) and average distributions between 1998-99 and 2001-02. GFC compares 2006-07 peak with 2009 trough for both contributions and distributions.

After the through in activity, capital calls experienced faster recoveries than distributions (see first graph). Private equity managers tend to proactively support portfolio companies for defensive (protecting liquidity in stressed periods) and offensive reasons (attractive acquisitions and other growth investments for existing portfolio). Managers also seek to take advantage of the buying opportunities that difficult times provide.

On the distributions side, managers can quickly sell the highest quality companies, but tend to wait to exit assets until buyers can pay higher prices. Buyout managers are active investors with board control, strong alignment of interest, and the backing of patient and flexible capital.

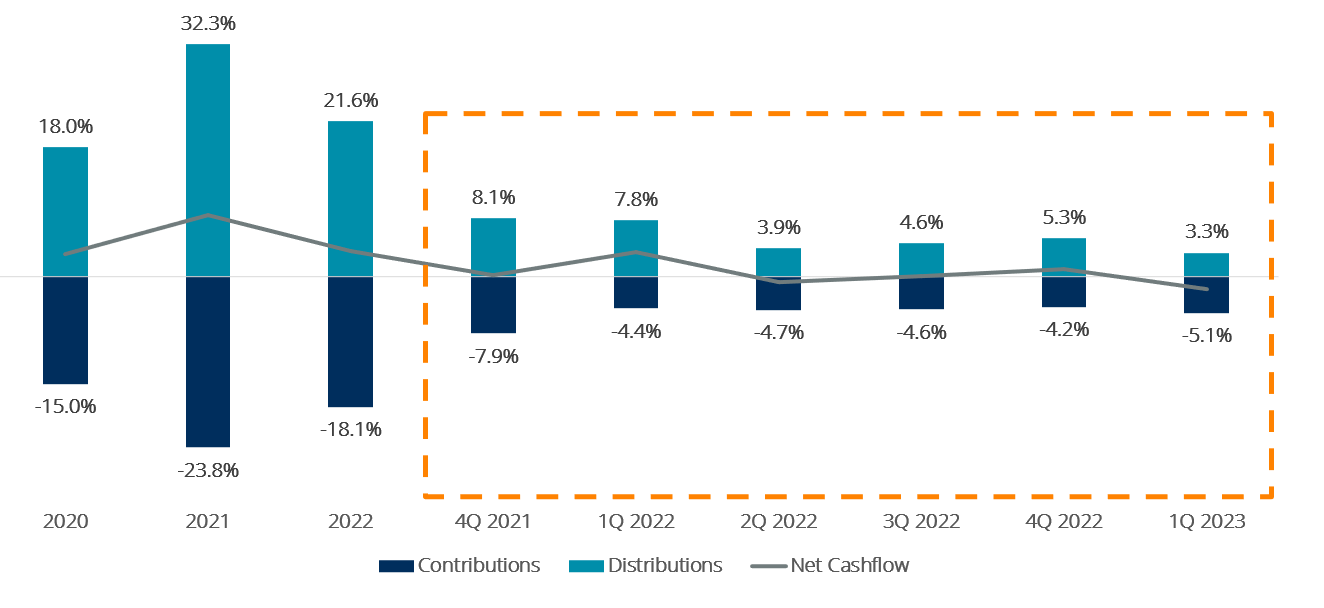

We have also looked at our own buyout portfolio in Europe and North America in order to derive insights on current trends. We appreciate a slight and gradual decrease in both contributions and distributions. Declines are nowhere close to the ones seen during the dotcom bubble or GFC shocks:

(Q4 2019 – Q1 2023; as % of commitments):

Source: Quarterly data related to investment activity of AltamarCAM Partners’ primary buyout funds from 2019 to 2022. Distributions for mature funds (more than 4 years old) and capital calls for young funds (less than 5 years old), which have all been accounted for using a simple average as a percentage of commitments. The sample is composed of 96 funds in 2020, 109 in 2021 and 109 in 2022. The net cash flow was calculated using the difference between capital calls and distributions for each given year.

Managers and investors expect that activity levels in 2023 would likely be lower than in 2022 as managers take a prudent approach to new investment underwriting (entry and exit price, growth, margin assumptions, etc.), acquisition debt becomes more expensive and limited, and the bid-ask spread between buyers and sellers persists in certain segments of the market, like consumer facing businesses.

If economies finally enter recession, private equity activity levels would probably contract further, in line with what has happened in prior crises, potentially reaching at least a 50% decline in investments and distributions from peak to trough.

As detailed in previous newsletters, like “Private Equity Performance Across the Cycle” (October 2022), best returns tend to be achieved in the aftermath of crises and shocks. In this past release we showed how North American and European companies in AltamarCAM’s primary program reached its highest returns1 in investments made between 2009 and 2014 after the GFC (2.2x total return compared to a 1.5x return for those investments made in the 2005-2008 period). Private equity managers are set to take advantage of emerging investment opportunity as fast as possible, while at the same time maintaining their investment discipline. Market uncertainty provides attractive opportunities and compelling reasons to remain invested.

1. Past performance is not necessarily indicative of future results, as current economic conditions are not comparable to past performance, which may not be repeated in the future

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.