Private Credit Strategies for Times of Dislocation

Advanced economies have suffered severe headwinds during 2022, with highest inflation seen since 1980s and consecutive rates hikes in the last twelve months. Although headline inflation has been on a downward trend since the second half of 2022, it is still far below the 2% target set by UK and European Central Banks and the Fed and core inflation remains elevated. In fact, the leveraged finance market and institutional investors are already discounting a period of lower growth while central banks continue their hiking stance and have announced additional hikes during 2023 until they are able to control the cost-of-living crisis. Downgrades in the leveraged loan market are outpacing upgrades at the fastest rate since 2020 and default and distress rates are expected to rise significantly.

Private credit strategies such as special situations and distressed debt perform best in these times of severe market dislocation. GP´s can take advantage of mispriced positions in debt that do not fully reflect potential fundamentals and convert debt into equity in companies that offer sound prospects but are facing cyclical distress situations.

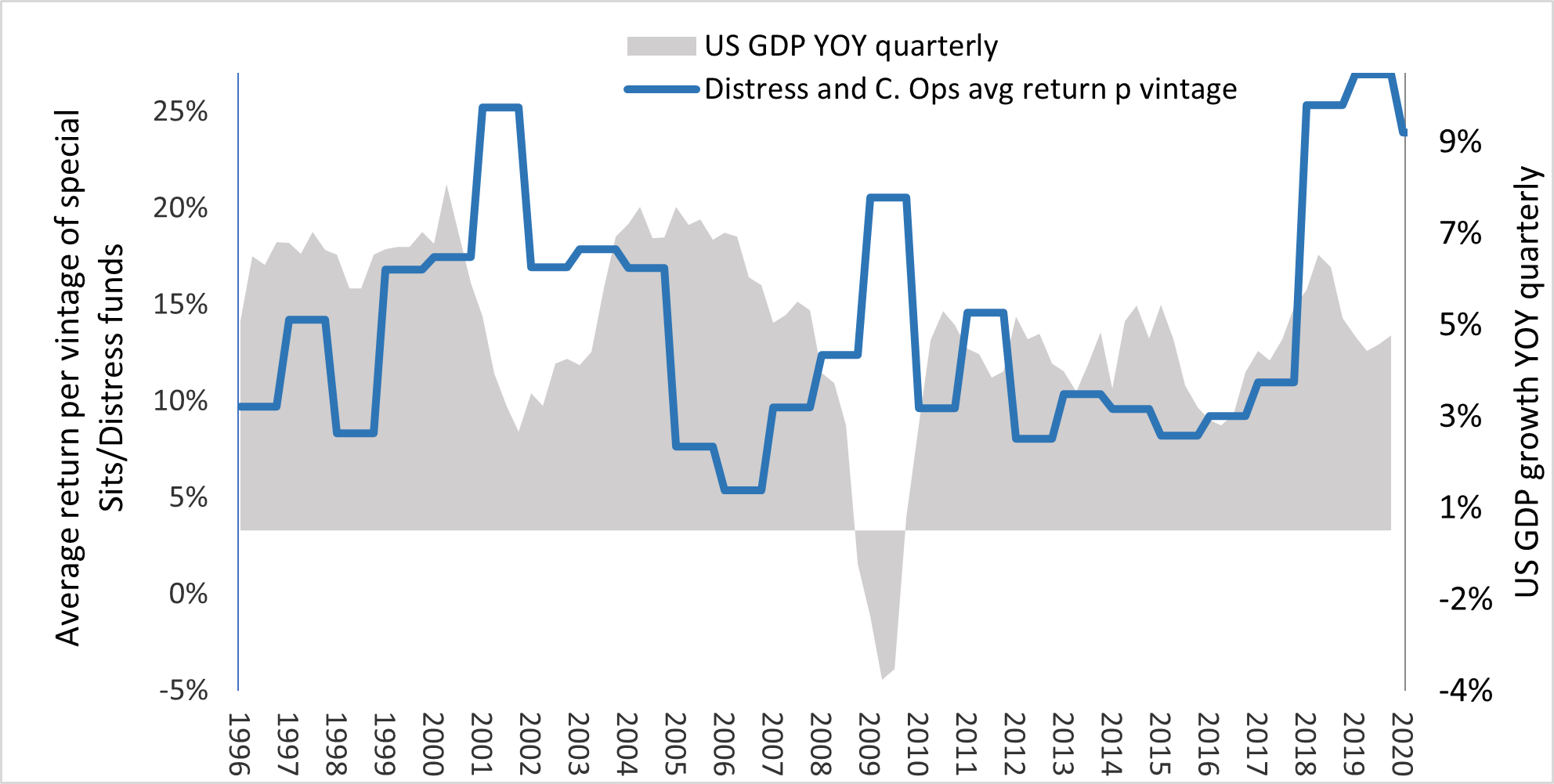

According to data from Preqin and compiled by Altamar CAM for 459 funds in the special situations and distressed debt space, the average internal rate of return during 1996-2020 was 13%. The chart plotting US GPD quarterly year-on-year growth and the return per vintage of the 459 funds in our data shows the very strong performance of these strategies precisely in periods of weak or even negative GDP growth:

Source: Preqin, FRED (St. Louis Federal Reserve) and AltamarCAM

In the low growth periods of 2001, 2009 and 2019, the average return was 23%, 10% higher than the average return in the period2.

In times of economic adversity, when both asset prices and companies´ P&Ls are impaired, a solid and skilled lender can identify mispriced debt assets and provide rescue financing to potentially sound companies that need capital and a financial or operational restructuring.

These private market lenders typically adopt the following type of transactions:

- Dislocated Credit: Mispriced debt due to market stress and lack of liquidity coupled with forced selling in Investment Grade, High Yield and Leveraged Loans markets or idiosyncratic risks affecting whole industries with no fundamental reasons.

- Rescue Lending: Lending to companies facing liquidity problems to fund their ongoing operations in the ordinary course of business to avoid imminent insolvency (i.e., DIP3 financing in the US).

- Distressed Credit: Investments in the debt of companies likely to go through a restructuring process and that might convert debt into equity. Lenders seek to have influence or control over the turnaround of these companies.

These are all sophisticated strategies. Their returns could be very attractive and provide an anticyclical hedge. However, investors should bear in mind:

- The importance of selectivity: The return dispersion in our data base is 88% between the best and the worst performers. Therefore, it is very important to conduct a comprehensive due diligence of managers to select the best performing ones.

- Volatility: Some investments may be executed via the high yield or leverage loan markets and exhibit higher volatility than other private credit strategies. At times, the fulcrum security (that gives control to the lender of a company going through an insolvency proceeding) or the mispriced debt position have a market beta and are subject to market volatility.

Within this context, an allocation to special situations and distress debt funds can offer investors an attractive and differentiated alternative to traditional fixed income strategies during times of economic distress. To execute it, a fund of funds is a great option that mitigates risk through efficient portfolio diversification, reducing the standard deviation of the underlying investments returns.

- Statement based on the argument of the article

- Data associated with the source of the graph above

- Debtor-in-possession (DIP) financing is a special kind of financing meant for companies that are in bankruptcy. Only companies that have filed for bankruptcy protection under Chapter 11 are allowed to access DIP financing, which usually happens at the start of a filing. DIP financing is used to facilitate the reorganization of a debtor-in-possession (the status of a company that has filed for bankruptcy) by allowing it to raise capital to fund its operations as its bankruptcy case runs its course

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.