Is it Time to Invest in Private Loans?

Since February of 2022 we have witnessed a fast-paced change in the interest rate landscape in Europe and in the US. During this period traditional fixed income strategies have largely underperformed private credit. However, once rates approached 4%-5%, investors have taken advantage of these higher nominal rates to invest in nominal fixed coupon bonds and bills. In this market environment why should investors continue targeting private credit?

The inflation driven tightening in monetary policies drove fed fund rates from 8 basis points in January of 2022 to 5.33% in October of 2023 and European Central Bank raised its refinancing rates from 0.0% to 4.5% between July 2022 and September of 2023.

This dramatic increase in rates impacted fixed income markets in different ways:

- Traditional fixed coupon public bond indices suffered important corrections while loan markets, in particular private direct loans, performed much better. For instance, in 2022 the Morningstar Global Corporate Bond Index fell 23.2% while the Cliffwater Direct Lending Index grew by 9.2%. In the period January to end of September 2023 these indices reported a loss of 5% and a gain of 6.5% respectively.

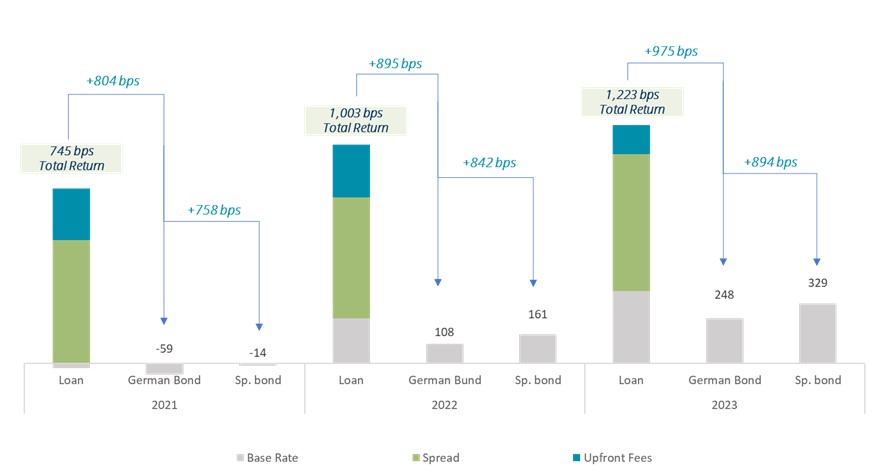

- The returns1 offered by bonds and loans improved during this time, but private direct loans improved more than other public market alternatives, such as sovereign bonds. In the chart below, the European loans in the Altamar CAM portfolios2 generated an average return of 745 basis points (bps) in 2021, 1003 bps in 2022 and 1223 bps in the first semester of 2023. German and Spanish sovereign yields also grew over that period but the increase in return was lower and so the premium of loans versus German and Spanish sovereign credits grew from an average of 804 bps and 758 bps in 2021 to 975 bps and 894 bps respectively3.

Source: Altamar CAM (Altamar Private Debt Direct Lending Funds including Altamar Private Debt I, AltaCAM Global Credit II and Altamar Private Debt III). Investing.com for sovereign bonds data.

- Leverage levels have decreased. Altamar CAM credit European loan portfolios2 have seen average leverage3 level for new loans decrease from 5.4X in 2022 to 4.9X in 2023 (and to 4.7X if we include European and US structured loans).

- As a result of the above, there has been a significant improvement in the return compensation for the risk taken. We measured this compensation or risk premium dividing the loan return by the average leverage of the loans structured each year. This ratio has notably improved from 1.58X in 2021 to 1.85x in 2022 and 2.43x in 2023.

- Loan protection measured as the LTV4 ratio has also improved in our loan portfolios, decreasing from 44% in 2021 to 38% in the first semester of 2023.

Overall, the market has become a lender´s market. The terms at which capital providers can invest are the best ones we have on record at AltamarCAM. Moreover, as an asset class it is harder to disregard private credit as a necessary component of any investment portfolio for the following reasons:

- First, the role of private loans in the market has consolidated as a source of financing, especially for LBOs and as an opportunity for investors. In 2023 86% of the new loans5 to finance LBOS were private loans versus 14% of bank or liquid leverage loans.

- Second, the last two years have shown that the performance3 of private loans has diverged largely from the rest of the fixed income market. This decorrelated performance can help optimize the performance of any portfolio.

Against this background, the higher for longer view of interest rates could raise concerns about the risk of a surge in defaults. It is logical to think that defaults will grow as they remain very low in historical terms. However, the past 20 years of history, including the recent Covid related increase in distress and default levels, have shown that losses given default have been moderate6.

All the above could well explain why according to the H1 2023 Preqin Investor Outlook for Alternative Assets reported that 88% of investors said investments in this asset class had either met or exceeded expectations and why one could conclude that even if the higher bond nominal interest rate has increased the broad attractiveness of traditional fixed income, there is very good reason to continue committing capital into private debt.

1. Returns for private direct loans are measured by the average estimated 3-year gross IRR (base rate + spread + OID/3) and sovereign bond returns are measured by the average IRR quoted in the market in each particular year. For the purposes of this comparison, we have used the loans structured in each of those years and compared it to the average market yield of 6-year sovereign bonds. Past performance is not necessarily indicative of future results, as current economic conditions are not comparable to past performance, which may not be repeated in the future.

2. Data includes Altamar Private Debt I, AltamarCAM Global Credit II and Altamar Private Debt III.

3. Past performance is not necessarily indicative of future results, as current economic conditions are not comparable to past performance, which may not be repeated in the future.

4. Loan to Value ratio.

5. Pitchbook LCD. “Count of LBOs financed in BSL vs private credit markets”. (September 26, 2023)

6. Peak quarterly losses of the Cliffwater Direct Lending Index reached -3.3% in 2009 and -1.2% in 2020.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.