Investment

areas

Specialised in alternative asset management

We offer unique access to a broad investment platform of private equity, venture capital, life sciences, real estate, infrastructure and private debt assets, driving the ability to execute tailored and complex investment strategies.

Private equity

We promote the growth of companies by boosting innovation, productivity, competitiveness and job creation, with an investment philosophy focused on obtaining ‘alpha’.

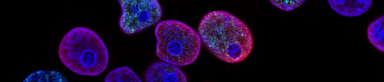

Venture capital

We drive innovation through various programmes, investing in a selection of the best venture capital managers globally.

Real estate

We take advantage of the extensive experience in real estate to create a balanced portfolio of funds and launch real assets platforms.

Infrastructure

We invest in essential assets which are paramount for society, with stable and predictable cash flows.

Debt

We invest in credit assets granted by non-bank financial institutions through funds which combine liquid and illiquid strategies to achieve significant advantages.

Our investment programs