Infra - Embedded Resilience

Infrastructure is an investable asset class which comprises assets that are essential to guaranteeing competitiveness and providing basic services. It offers valuable resilience and low volatility in today´s environment thanks to the visibility of its long-term cash flows.

Most revenues are based on contracts and business models that are indexed to inflation. Infrastructure assets typically have in place long-term maturities and a high component of either fixed rate financing or interest rate hedges. In addition, both higher inflation and supply chain disruptions are increasing the cost of building new infrastructures.

Infrastructure as an investable asset class comprises assets that are essential to guaranteeing competitiveness and providing basic services like power, water, and telecommunications. To assess the resilience of infrastructure in times of increasing inflation and interest rates, bear in mind that:

- Infrastructure is a capital-intensive asset class that is financed with a meaningful amount of leverage.

- Most infrastructure assets operate under long-term contracts that are inflation linked.

- Infrastructure assets are valued discounting future cashflows taking into account market interest rates.

Let’s next consider these factors in today’s macroeconomic environment of slowing growth, accelerating inflation, and increasing interest rates:

On the positive side:

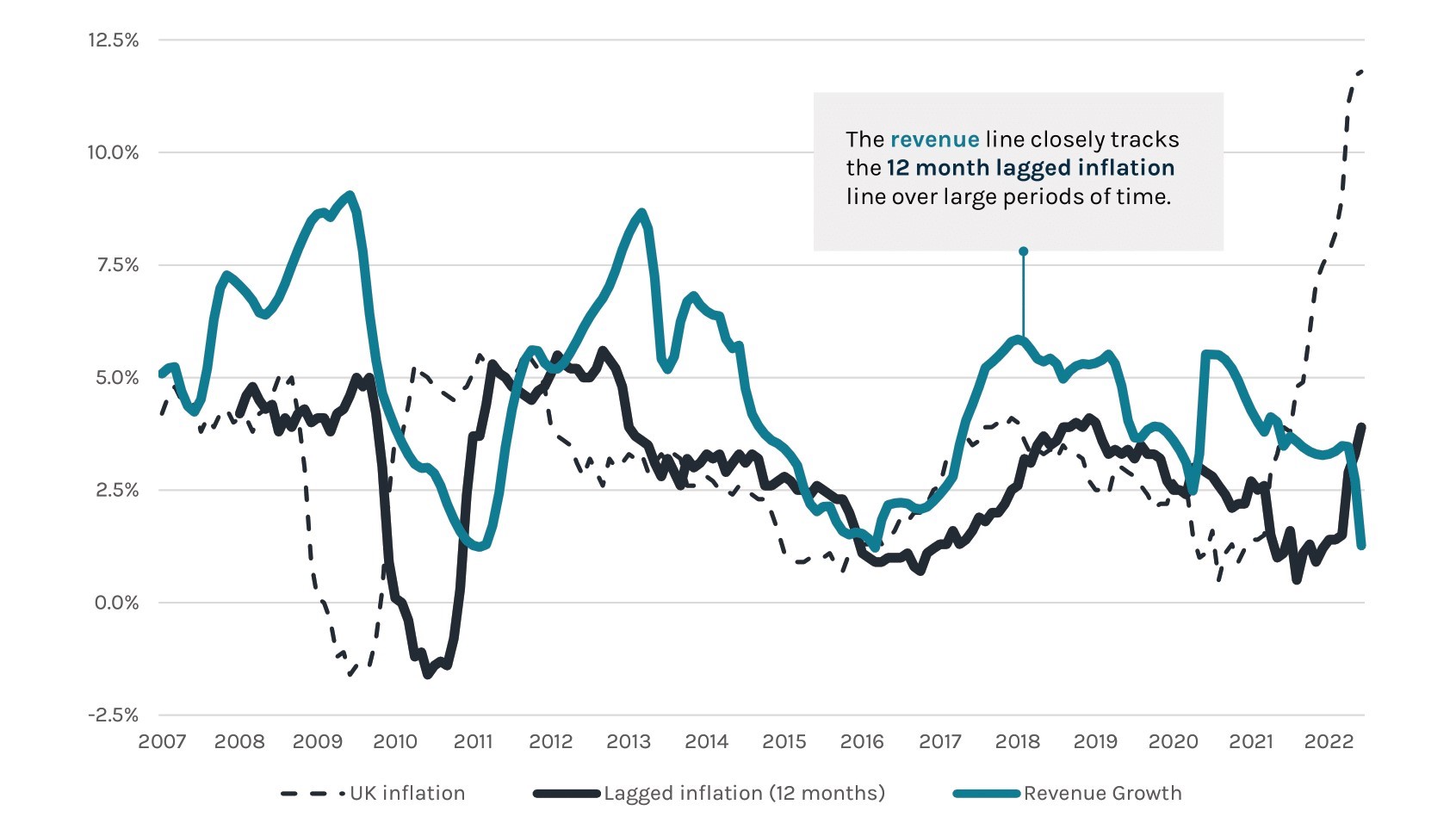

- Inflation passthrough – Most revenues are based on contracts and business models that are indexed to inflation, as we can appreciate in the following graph plotting the revenue growth of a sample of private UK infra companies against a lagged inflation series:

The Impact of Inflation on Infrastructure Revenues

Source: EDHEC Private UK Infrastructure Companies 2007-2021; 12-month moving average revenue growth and inflation (“RPI”) change

- High proportion of fixed rate debt – Infra assets typically have in place long-term maturities and a high proportion of either fixed rate financing or interest rate hedges.

- Increasing replacement costs of existing assets – Both higher inflation and supply chain disruptions are increasing the cost of building new infrastructures, enhancing the uniqueness and scarcity of the existing infrastructure assets.

- Higher interest rates reduce the fiscal ability of the public sector to supply new infrastructures – Rising rates increases budget constraints and makes even more critical the financing from private investors.

On the negative side:

- Increases in interest rates may have a negative impact on asset valuations: Despite the natural inflation hedges of infra-assets, higher interest rates may impact valuations. This is partially mitigated as discount rates are based on long-term average interest rates. The use of long-term averages mitigates volatility in short-term rates.

- Assets with high leverage and short-term maturities may face increases in financing costs and an erosion in value. To mitigate the short-term refinancing risk, investment managers seek to implement long-term financial structures with different seniority and staggered maturities.

- Looking at the recent history, prolonged periods of high interest rates and low Inflation may affect Infrastructure valuations as it happened from 1982 to 1986.

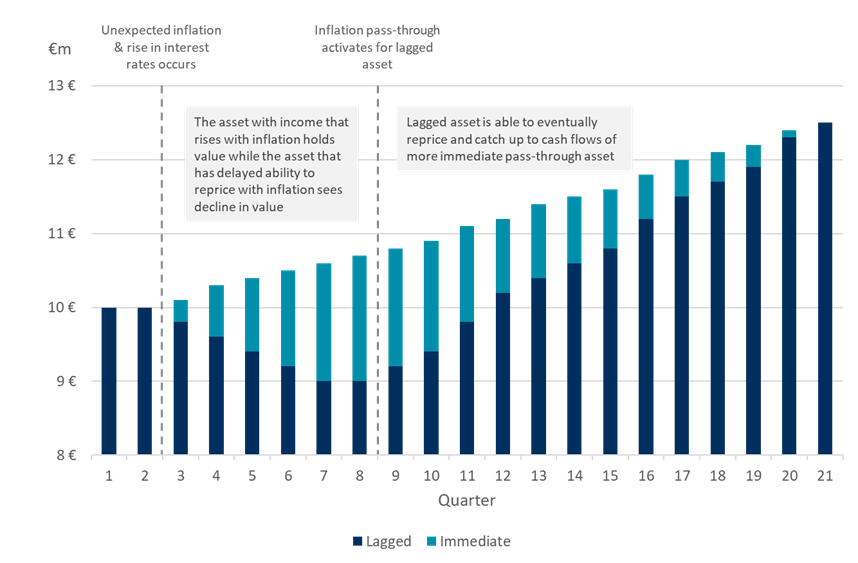

As we can appreciate in the graph below, the timing and ability to grow revenues to keep pace with inflation are key to preserve the value of an infrastructure asset. The assets represented with the dark blue bar are the ones that are not able to reprice immediately when inflation grows and therefore show declines in valuations, while the ones represented in light blue are able to reprice immediately and sustain steady increases in their valuation.

The Impact of Inflation on Infrastructure Investments: Immediate vs Lagged Pass-Through

Source: AltamarCAM Analysis, Ares Infrastructure

Clearly, in an inflationary environment with rising rates, the ability to reprice quicky plays a fundamental role in preserving value in the short-term.

In summary, private Infrastructure assets provide essential services to society while having natural inflation hedges that offset higher interest rates and financing costs, showing low volatility. They offer the resilience1 and stability needed to cope with the challenges of the current macroeconomic environment.

1. Past performance is not necessarily indicative of future results, as current economic conditions are not comparable to past performance, which may not be repeated in the future.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates “AltamarCAM“) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.