Why Are GP-led Secondaries an Asset-Class Where You Need to Invest and You Cannot Live Without

As global private markets investors, we’re keenly aware of the differing perceptions of continuation vehicle, or “CV”, transactions.

While some have viewed the evolution of CVs to simply become another path to liquidity, others have flagged concerns with motivations, conflicts, and insufficient notice periods.

We have formed a core set of views regarding CVs over our decade plus of involvement in these transactions. Our enduring perspective is that CVs will continue to provide a much-needed solution for private markets investors.

At the same time, we continue to believe that GP-led transactions often represent the best risk/reward opportunities in secondaries.

There is a broad universe of GP-led transactions, but when properly selected, these deals often have clear visibility on growth-drivers, fewer information asymmetries and very strong alignment – effectively the recipe for attractive return upside with muted downside risk.

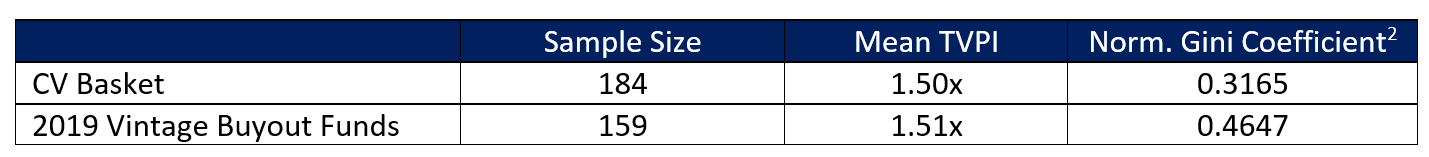

While still a nascent market, we are just beginning to see early results from the first wave of CV transactions. Evercore Private Capital Advisory recently published a report in collaboration with HEC to independently evaluate the performance of 140 CVs formed between 2018-2022. While it’s still quite early to draw any significant conclusions from a data set where the majority of the results reflect unrealized performance, the report nonetheless identifies one significant finding. When comparing a basket of single-asset CVs relative to buyout funds over the same period, the CV basket performs largely in line with the buyout funds, but with less return dispersion. Effectively, this result supports the conclusion that CVs provide desirable upside with less risk.

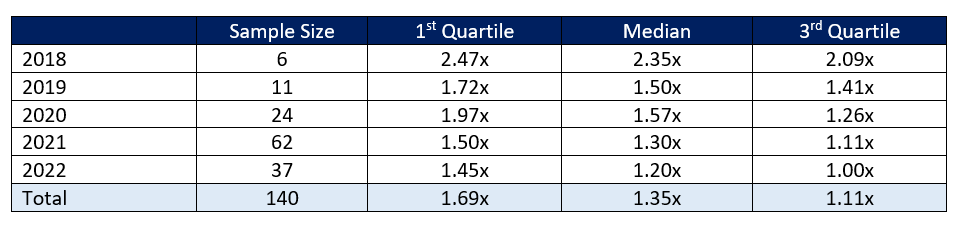

Our careful review of the data also resulted in another interesting conclusion. Median performance of the CVs in the sample provided is rather unremarkable. The risk/reward performance benefits of CVs are primarily observable in only the top quartile of CV transactions. This leads us to conclude that investing in CVs is not simply an allocation exercise — success is primarily driven by asset-selection.

Continuation Fund Performance Quartile by Vintage Year (Total Value to Paid-In or “TVPI”):3

Overall, however, this study and our own returns only fortified our views on GP-led transactions. If you are not active in CV investing, you may effectively be missing a very good part of the market.

What is the role of a GP Led secondaries fund in the portfolio of sophisticated investors

Success in the GP-led market requires deep relationships, a firm understanding of transaction complexities, a direct-investment like analytical approach – it’s much more than a pricing exercise.

But this is the segment of the market where alpha in secondaries is routinely created, and prudent investors in this market have been and will continue to be rewarded.

A well-executed strategy in GP-leds could deliver premium returns – more in line with direct strategies – yet with a substantially lower risk-profile, greater diversification and a shorter duration, and would thus be a nicely additive component to any investor’s portfolio.

1 Source: Evercore Private Capital Advisory – An Early Look at Continuation Fund Performance, March 2024.

2 Normalized Gini Coefficient is a measure of return dispersion, with a lower coefficient indicating a more even dispersion of returns across the sample universe.

3 Source: Evercore Private Capital Advisory – An Early Look at Continuation Fund Performance, March 2024.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates „AltamarCAM„) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.