Portfolios of Funds –

Homemade or Outsourced?

Investors in private assets need to be mindful about costs, extensive diversification, and manager proliferation. Hiring myriad managers does not ensure they will be winners collectively. To the contrary, the law of averages works against investors.

In our white paper Targeting Private Assets, we examine the performance of the endowment model. R. Ennis2 finds that, since the Global Financial Crisis, endowments have underperformed their risk-based benchmarks, a public fund composite, and a 70% equities / 30% bonds passive portfolio.

R.Ennis identifies two key performance drags:

- High costs and overdiversification. Overdiversification tends to reduce the overall specific business exposures that private equity managers seek. With such high diversification, endowments cannot overcome the impact of high active management fees.

- Manager proliferation. Large endowments have an average of over 100 asset managers and in excess of 1,000 active company bets that, unfortunately, end up cancelling one another out.

K. Polen makes three most sensible recommendations:

- Focus on the quality of the business approach in creating a strategic advantage,

- Assess the quality of the organization, and

- Give paramount importance to the alignment of interests.

Clearly, thus, investors in private assets need to be mindful about costs, extensive diversification, and manager proliferation. Hiring myriad managers does not ensure they will be winners collectively. To the contrary, the law of averages works against investors.

These insights and recommendations by both Ennis and Polen are most relevant to the question as to whether investors should create their very own portfolio of funds or outsource the manager selection and portfolio construction process through a fund of funds.

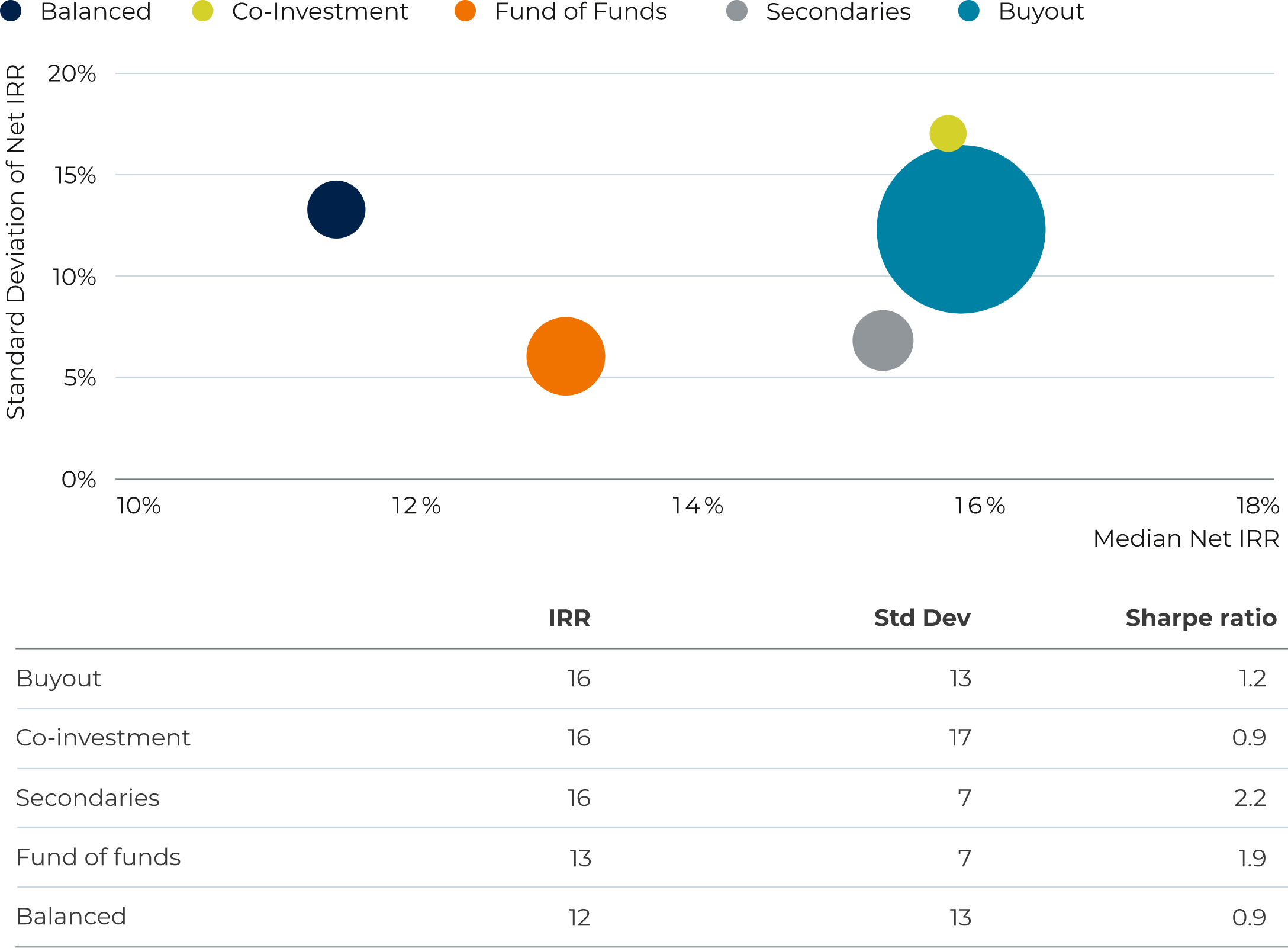

In its 2020 Private Equity and Venture Capital report, Preqin provides comparative data for the relative size and performance of funds of funds, including balanced funds diversified across growth stages:

Private Equity: Risk/Return by Fund Type (Vintages 2007-2016)

For the vintages 2007 – 2016, funds of funds delivered 3 a Sharpe ratio of 1.9x, clearly outperforming the average of buyout funds – Sharpe ratio of 1.2x – and balanced funds diversified by stage and approach – Sharpe ratio of 0.9x. Funds of funds do seem to be earning their fees through astute manager selection and robust portfolio construction and risk management.

Diversified portfolios of funds managed internally with the appropriate processes, teams, and experience could potentially achieve results similar to those achieved by funds of funds. The experience of the endowment funds, however, should serve as a warning about creating and indulging in excessive complexity.

Robert S. Harris recently published a paper in the journal of Financial Economics studying the performance of funds of funds. Very insightfully, Harris questions whether the large blue universe of single funds in the chart above is the appropriate benchmark for funds of funds in as much as investors “would find it difficult to invest in (single managers) directly”. So, the large blue dot may not even represent the actual opportunity set of investors.

To summarize, funds of funds outperform the single fund universe on a risk-adjusted basis. Furthermore, this universe may not be the appropriate benchmark as investors do not have access to all the managers in this universe.

1This is not an investment recommendation

2Richard M. Ennis: https://richardmennis.com/blog/endowment-performance

3Past performance is no guarantee of future returns.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates „AltamarCAM„) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.