Venture Capital as an Access Class

Returns for 60/40 long-only strategies are driven primarily by the asset class itself not by the performance of top managers. Unlike 60/40 strategies, returns for investors in private assets are critically determined by access to the best managers.

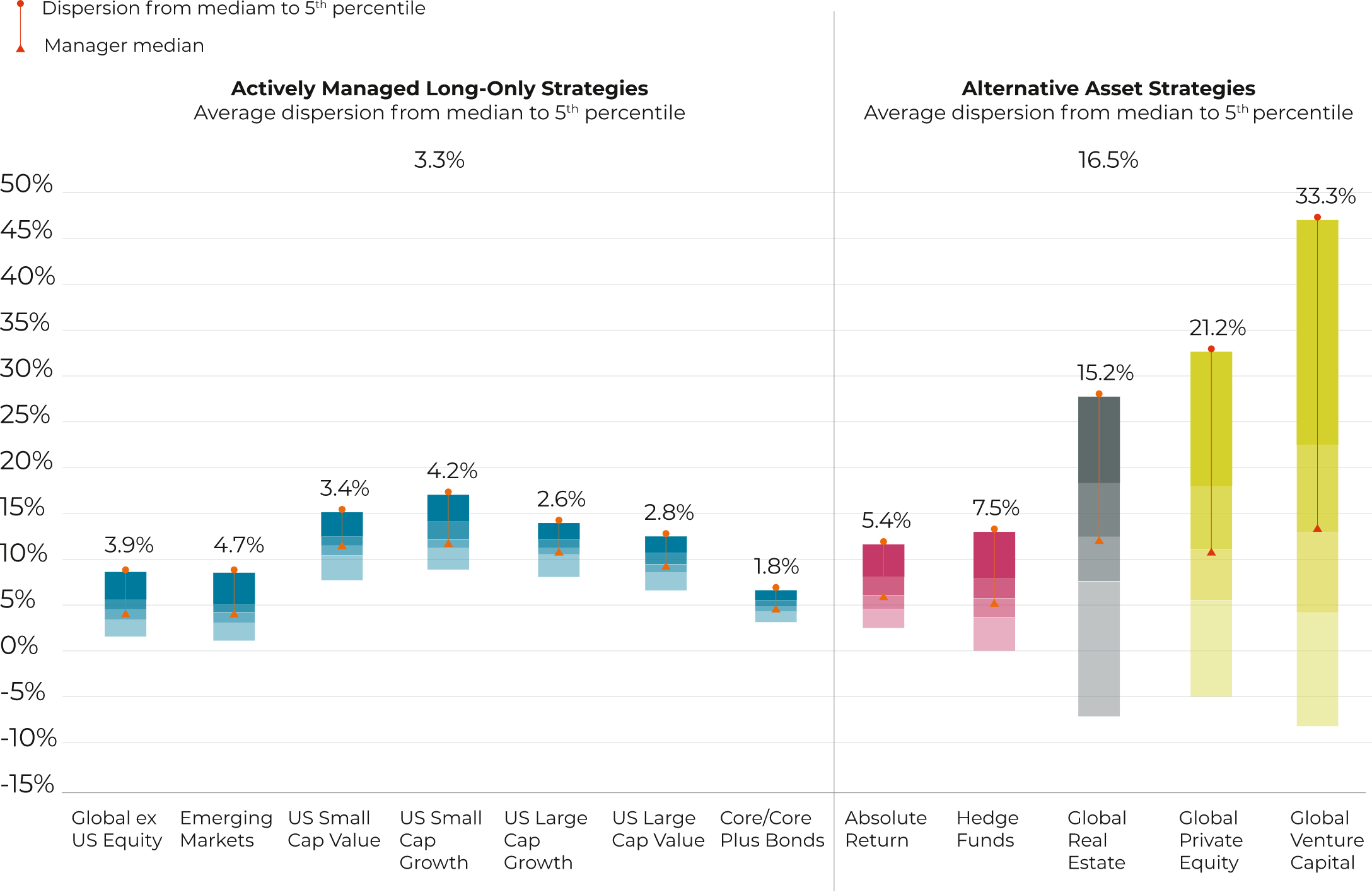

The average dispersion from median to top manager has been 3.3% for traditional 60/40 long-only strategies. Dispersion for private equity is 21.2% and for venture capital, a staggering 33.3%, a tenfold increase over long-only 60/40 strategies.

Whereas in 60/40 strategies deploying capital is not an issue, it happens to be the key make-it-or-break-it issue in private assets, particularly so in venture capital. In venture capital, the name of the game is access. That is why we regard venture capital as an access class. No premium access, no premium returns above the median. To get top results, you need top access.

An asset class is a coherent grouping of securities that share similar characteristics and common risk factors. These risk factors cannot be diversified away. As a result, securities within each asset class earn an inherent non-skill-based return.

The standard asset classes are bonds and equities. Over the past 10 years, infrastructure and credit have become accepted as bona fide asset classes that should be included in the strategic asset allocation opportunity set. What about venture capital?

What can we take away from this analysis?

A key test as to whether an asset grouping deserves status as an asset class at the strategic asset allocation level is running optimization numbers, as we have done in our most recent white paper Targeting Private Assets.

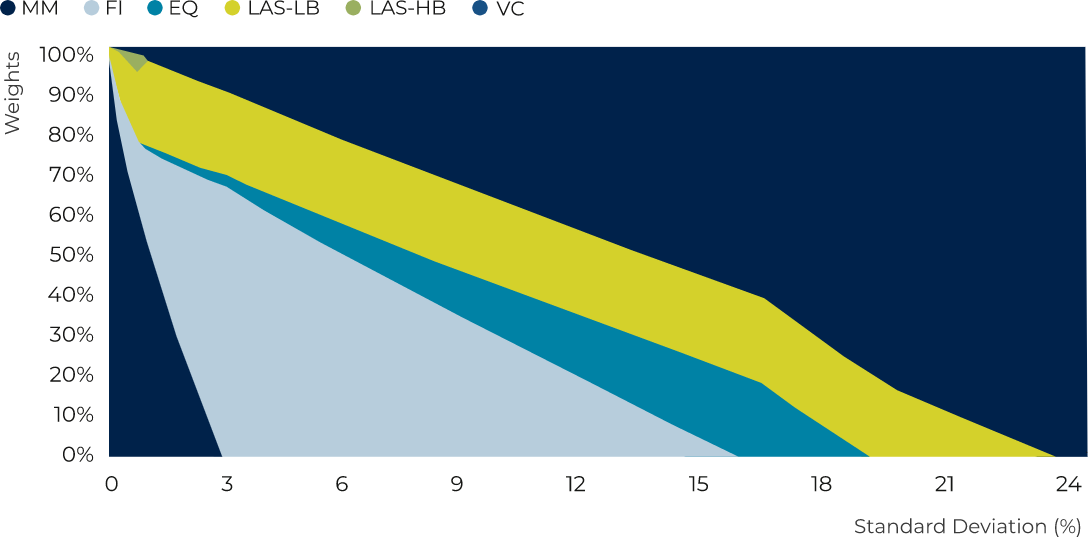

We start with money markets, bonds, and equities, allow the optimizer to allocate up to 20% to liquid alternative strategies, and then let it allocate to venture capital as much as it thinks fit. Here are the results:

Frontier Area – Venture Capital

Source: Eccleston Partners

MM – Money Markets, FI – Fixed Income, EQ – Equities, LAS – Liquid Alternative Strategies, LB – Low Beta, HB – High Beta, VC – Venture Capital

The optimizer would allocate as much as the risk budget would allow! What an asset class to be invested in. Venture capital has an expected Sharpe ratio of .41 vs .17 for bonds and .35 for equities. It also has an expected correlation of 0 with bonds and .7 with equities. No wonder the optimizer falls in love with venture capital.

Once we have venture capital in our long-term asset allocation, we need to access managers. Let’s start taking a look at returns delivered by asset classes and by top 5th percentile managers across 60/40 long-only strategies, alternative liquid strategies, and private assets:

Average Annual Manager Returns by Asset Class

July 1, 2008 – June 30, 2018.

Source: Cambridge Associates LLC.

Note: Returns for bond, equity, and hedge fund managers are average annual compound returns (AACRs) for the ten years ended June 30, 2018. Only managers with performance available for the entire period are included. Returns for private investment managers are horizon internal rates of return (IRRs) calculated since inception to March 31, 2018. Time weighted returns (AACRs) and money weighted returns (IRRs) are not directly comparable.

Returns for 60/401 strategies are driven by the asset class itself not by the performance of top managers. To illustrate, US large cap value strategies have earned about 8% per annum over the 10 years in the study period. Top 5th percentile managers have added 2.8% per annum. For these outstanding managers, skill has thus contributed about 25% of returns and asset class beta about 75%. For the seven sub asset classes, the average dispersion from median to top manager has been 3.3%.

As we look to liquid alternative strategies and illiquid private assets in the right, we appreciate that median returns continue stuck in the 5 to 10% range but that dispersion skyrockets. It is now 21.2% for private equity and a staggering 33.3% for venture capital, a tenfold increase over long only 60/40 strategies. In private assets, getting the right manager is key and particularly so for venture capital.

Persistence of Performance

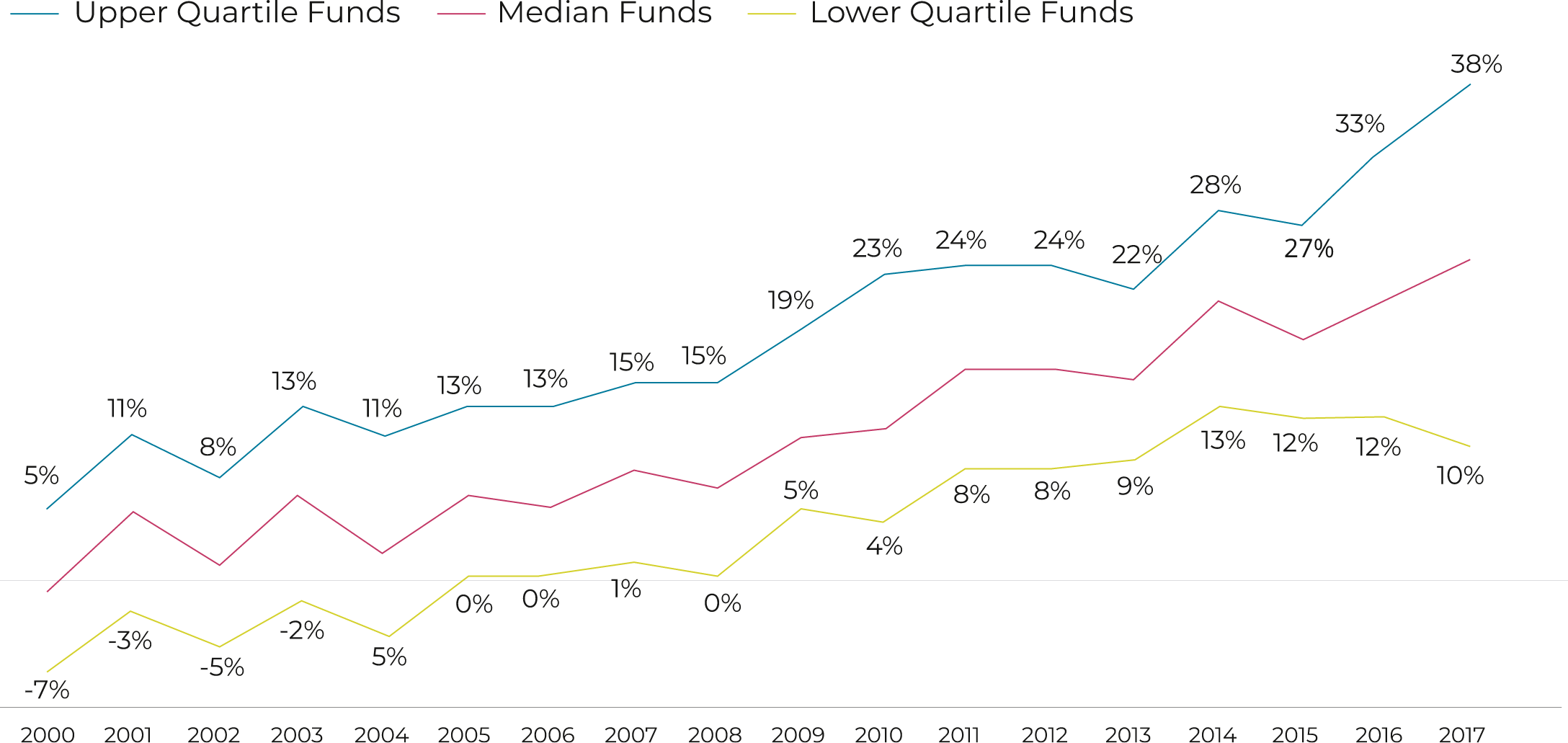

This dispersion between great and poor managers in venture capital has persisted over time:

Net IRR per Vintage and Fund Type

Source: Cambridge Associates Benchmarks Index as of Q4 2020.

Finally, empirical evidence reveals that there is persistence in those that make it to the upper quartile. Managers up there do not rotate in and out every quarter. The industry´s rule of thumb of investing with GP´s that have previously performed well and avoid those that have not remains consistent with these empirical results.

Here we meet the limitations of venture capital as an asset class. Whereas in long only 60/40 strategies deploying capital is not an issue, it happens to be the issue in venture capital. In venture capital, the name of the game is access. That is why we regard venture capital as an access class rather than an asset class. No premium access, no premium returns above the median. To get top results, you need top access.

How do we know? Just take a look at our track record, as detailed in our white paper Targeting Venture Capital.

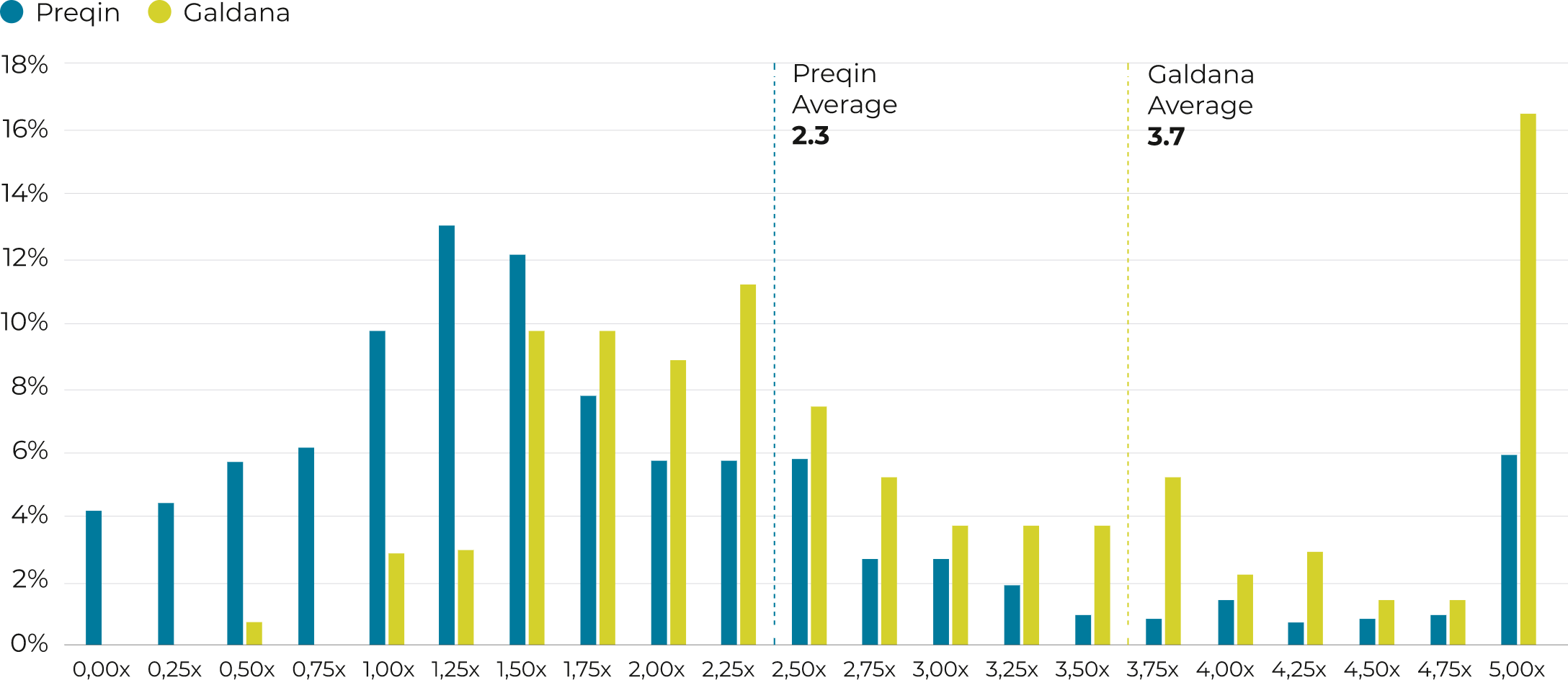

TVPI Track Record – Galdana and Preqin

Source: Galdana and Preqin.

- Over 20% of Preqin’s sample delivers TVPI’s below 1.0x. In the case of Galdana’s managers, the rate stands at just below 1%. Let’s new look at winners.

- In Preqin’s sample, not quite 10% of funds earn TVPI’s in excess of 4.0x. Galdana’s percentage of big winners stands in excess of 20%. Funds earning TVPI’s of 5x or higher stand at over 15%.

2Past performance does not guarantee future returns.

3It comprises the investments made by Galdana Ventures FCR, Galdana Ventures II FCR, Galdana SPV I, S.C.A., SICAV-RAIF and Galdana Ventures II, SICAV-RAIF.

4This note draws on our white paper Targeting Venture Capital which you can access through our website. The white paper provides further details and references on data sources.

5This is not an investment recommendation.

IMPORTANT NOTICE:

This document has been prepared by Altamar CAM Partners S.L. (together with its affiliates „AltamarCAM„) for information and illustrative purposes only, as a general market commentary and it is intended for the exclusive use by its recipient. If you have not received this document from AltamarCAM you should not read, use, copy or disclose it.

The information contained herein reflects, as of the date hereof, the views of AltamarCAM, which may change at any time without notice and with no obligation to update or to ensure that any updates are brought to your attention.

This document is based on sources believed to be reliable and has been prepared with utmost care to avoid it being unclear, ambiguous or misleading. However, no representation or warranty is made as of its truthfulness, accuracy or completeness and you should not rely on it as if it were. AltamarCAM does not accept any responsibility for the information contained in this document.

This document may contain projections, expectations, estimates, opinions or subjective judgments that must be interpreted as such and never as a representation or warranty of results, returns or profits, present or future. To the extent that this document contains statements about future performance such statements are forward looking and subject to a number of risks and uncertainties.

This document is a general market commentary only, and should not be construed as any form of regulated advice, investment offer, solicitation or recommendation. Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. Prospective investors of any alternative investment should refer to the specific fund prospectus and regulations which will describe the specific risks and considerations associated with a specific alternative investment. Investors should carefully review and consider potential risks before investing. No person or entity who receives this document should take an investment decision without receiving previous legal, tax and financial advice on a particularized basis.

Neither AltamarCAM nor its group companies, or their respective shareholders, directors, managers, employees or advisors, assume any responsibility for the integrity and accuracy of the information contained herein, nor for the decisions that the addressees of this document may adopt based on this document or the information contained herein.

This document is strictly confidential and must not be reproduced, or in any other way disclosed, in whole or in part, without the prior written consent of AltamarCAM.